Articles

Community Banks: A Safe Haven for Corporate Cash

- By Catherine Berman, CEO and Co-Founder, CNote

- Published: 7/18/2025

When headlines fill with stories of high-profile bank failures and volatile markets, corporate finance teams often ask a simple question: Where is our cash safest?

It’s a question that has shaped treasury strategies for decades, and too often, it comes with an automatic answer: “Stick with the biggest banks.” But beneath the surface, the numbers tell a different story.

In 2023, a wave of regional bank failures, including high-profile collapses like Silicon Valley Bank, Signature Bank and First Republic, raised new concerns about interest rate exposure, liquidity risk and balance sheet complexity. While institutions of various sizes were affected, many community banks and credit unions remained resilient. With more conservative lending practices, higher reliance on insured deposits and simpler balance sheets, they were less exposed to the same vulnerabilities that triggered broader volatility in the sector.

As market volatility continues to test assumptions, these institutions are showing once again that stability doesn’t require size; it requires discipline. For corporate finance leaders navigating today’s risk environment, community banks offer a compelling case for rethinking where cash belongs.

Here are five reasons why community banks deserve a second look, not just for their local impact, but for their performance, resilience and ability to protect short-term corporate funds.

1. They Maintain Strong Capital Buffers

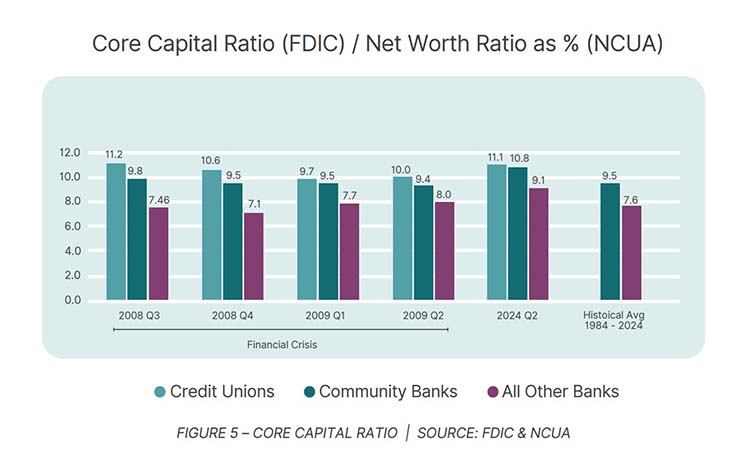

Community banks are better capitalized than their larger peers. As of June 2024, community banks reported an average core capital ratio of 10.84%, compared to 9.11% at larger banks (From Myths to Opportunities, page 5). Higher capitalization levels provide a cushion to absorb losses during periods of stress, protecting depositors from the fallout of adverse economic events.

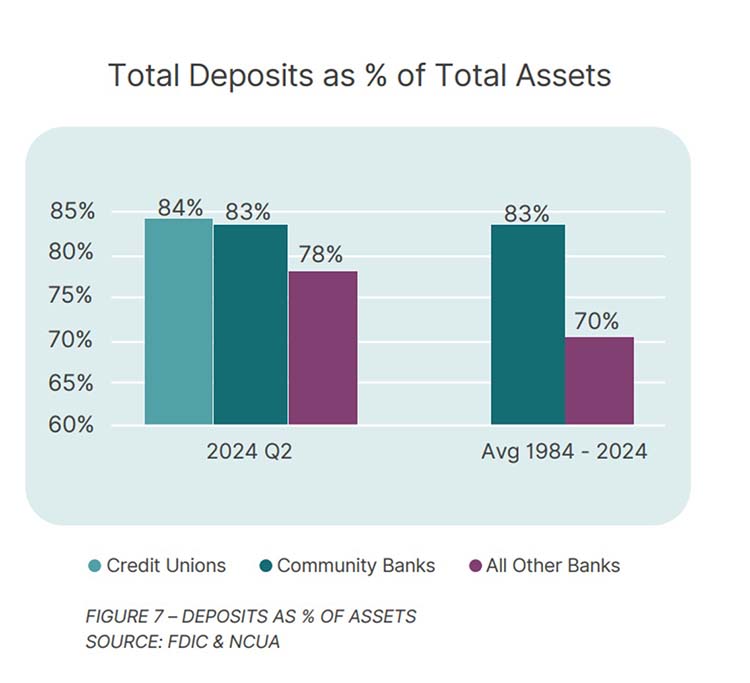

Deposit funding remains the backbone of community banking. Community banks fund 83% of their balance sheets through deposits, while larger banks rely on deposits for just 78% (From Myths to Opportunities, page 5). Moreover, 70% of community bank deposits are insured, a higher share than at larger banks (From Myths to Opportunities, page 15). This conservative funding mix reduces dependence on more volatile wholesale borrowing.

2. They Excel at Prudent Lending

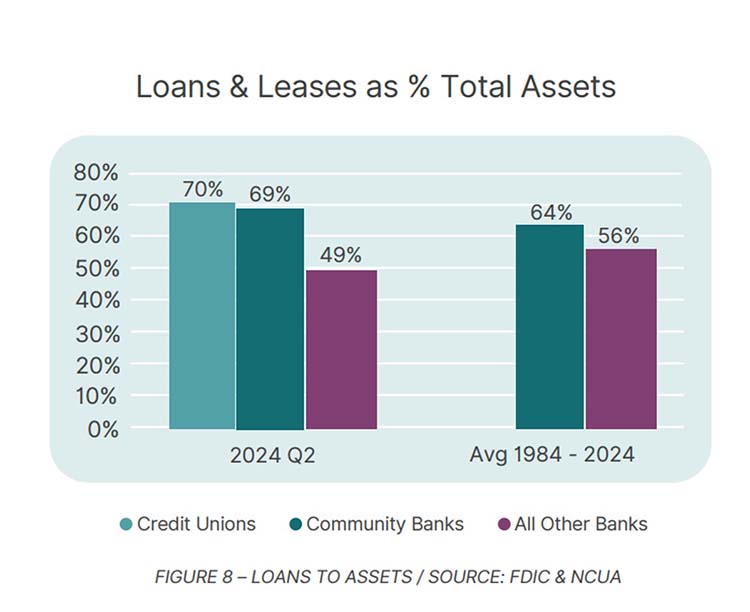

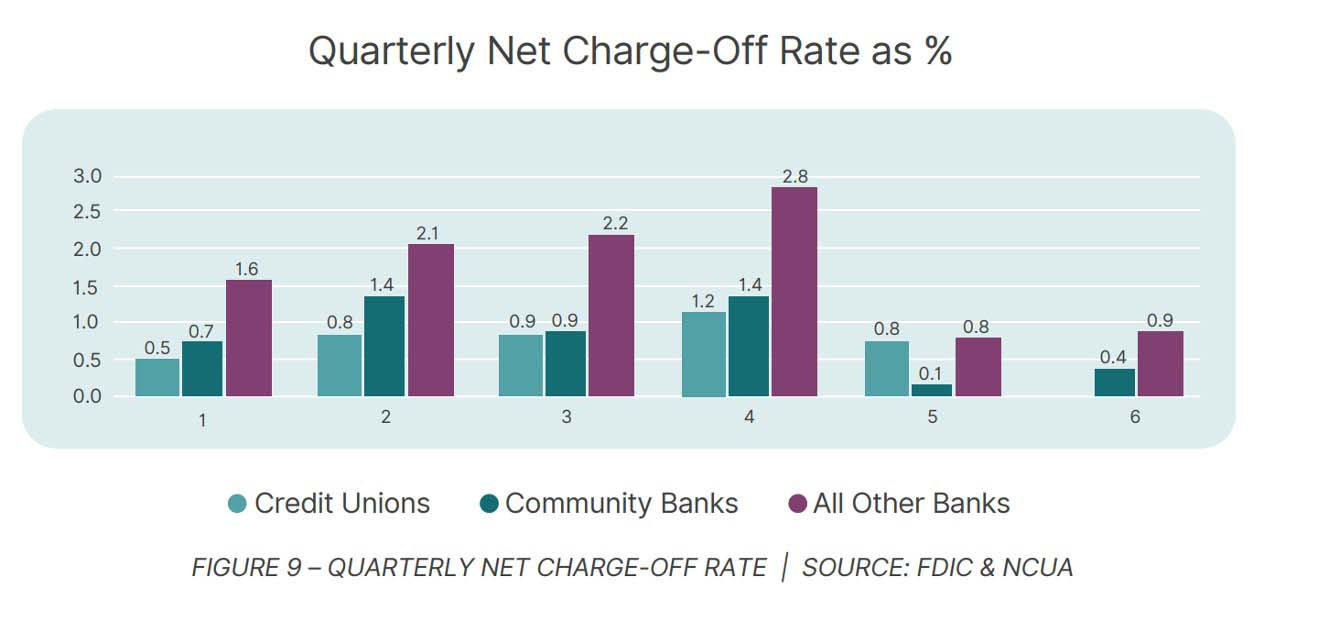

Despite lending more of their balance sheets than larger banks — 68.8% of assets, compared to 49% for large banks — community banks maintain lower credit losses (From Myths to Opportunities, page 16). Over four decades, community banks have reported an average net charge-off rate of 0.37%, significantly below the 0.89% for non-community banks (From Myths to Opportunities, page 16). As of mid-2024, the figure stands at just 0.14%.

3. They Deliver Competitive Yields

A persistent myth is that conservative lending must mean lower returns for depositors. Historical data proves otherwise: From 1984 to June 2024, the average cost of interest-bearing deposits at community banks was 3.42%, higher than the 3.31% paid by larger banks (From Myths to Opportunities, page 5). This balance of conservative risk with competitive rates makes community banks an attractive addition to a diversified cash strategy.

4. They Anchor Local Economies

Community banks play an outsized role in supporting local businesses, farms and families. By keeping lending decisions close to the communities they serve, they help stabilize local economies during downturns. Ben Bernanke captured this succinctly on page 3 of the white paper: “Community banks have a critical role in keeping their local economies vibrant and growing ... When you multiply these effects across the thousands of community banks in the United States, you really see how the lending decisions they make help the broader national economy.”

Final Thoughts

Size and safety are not the same thing. Community banks and credit unions have shown, year after year, that prudence, stability and competitive returns can go hand in hand. For treasury leaders seeking peace of mind without sacrificing yield, these institutions are worth a closer look.

To explore the full data and insights behind these trends, read the From Myths to Opportunities: Uncovering Value in the Community Banking Sector white paper. It provides a comprehensive look at how this overlooked segment of the financial system continues to deliver stability and impact for communities and institutions alike.

Copyright © 2026 Association for Financial Professionals, Inc.

All rights reserved.